Prepare compelling business cases and value propositions

Reply to and approach investors proactively with solid, data-driven and sector-specific investment propositions to get your location on the shortlist.

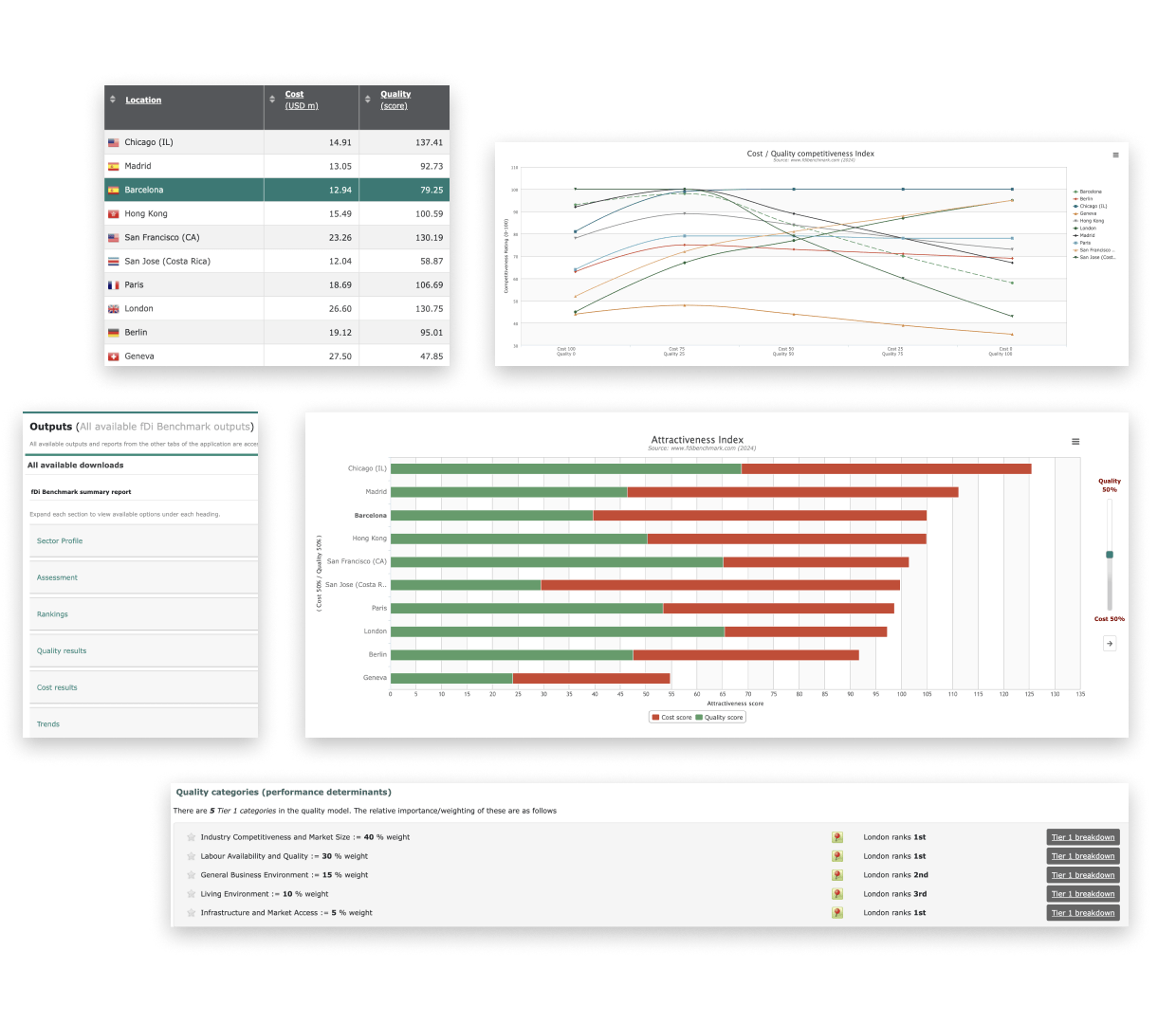

Assess the relative competitiveness of 900+ locations across 152 sectors. Our unique patented algorithmic technology is used by locations, intermediaries and investors alike to assess global footprint strategies.

Respond quickly and consistently to investment enquiries, as well as producing business cases customised to target investors.

We continually track quality and cost data points across the globe at country, state and city level.

Reply to and approach investors proactively with solid, data-driven and sector-specific investment propositions to get your location on the shortlist.

Identify your key USPs against competing locations within seconds and complement your press releases and marketing material with independent data and graphs.

Save time, capital and team resources by quickly accessing information on locations that your organisation can rely on and shortlist potential location options based on objective criteria.

Discover how fDi Benchmark can help your role or organisation

A user manual and short videos on key features will help you maximise the benefits of fDi Benchmark for your organisation.

Access to an exclusive member of the account management and onboarding team to guide you through the features and benefits of the system - aligned to your organisation's specific requirements.

Identify new business opportunities, better inform your investment decisions and empower your organisation with unrivalled FDI data.

This is a superb tool for creating operating cost comparisons with other major cities around the world. It allows us to distinguish ourselves by costs but also to find credible data in a large number of industries.

fDi Benchmark is a useful tool to DBT in supporting investment officers in service delivery by providing fast and credible location comparisons between the UK and other countries.

The FT tools we subscribe to are absolutely amazing and enable us to engage investors on a higher level. fDi Benchmark has ensured that we have a value proposition to offer. Companies that we meet are quite impressed and find the information very relevant.

fDi Benchmark sources its content from a number of leading global data sources, including the World Bank, the International Monetary Fund, Dun & Bradstreet, Towers Watson, National Statistical Agencies and the Financial Times.

In total, fDi Benchmark includes c.2,500 data points at the country level and c.600 at the state/city level. Data sources are clearly labelled in fDi Benchmark, including in graphs, tables and downloads.

The data is updated on a quarterly or annual basis, depending on the specific data point. Data newly released by our sources is typically updated on fDi Benchmark within one month.

fDi Benchmark currently has 153 sector profiles built into the application. The sector profiles have been built to represent typical investment projects across various sectors and include a quality and cost model to help benchmark the competitiveness of locations and assess their relative strengths and weaknesses.

Each sector profile includes a pre-determined three-tier weighted quality model. The cost model includes information on typical headcount, property and utility usage for that sector profile.

However, as each investment project is different, fDi Benchmark provides easy-to-use tools to tailor the quality data weights, operating costs quantities and employee information to the specific requirements of individual projects.

fDi Benchmark includes data on over 1,000+ locations, between country, state and city level. New locations can be added to the platform depending on data availability.